The notion of “perfect timing” when buying and selling property often comes up in conversations among professionals and homeowners. Certainly, it is everyone’s dream to buy low and sell high, but it’s equally important to recognize this ideal for what it is…a dream.

At Harvey Kalles Real Estate, our clients usually buy and sell within the same market, making this kind of perfect timing scenario quite rare.

At a recent sales meeting, we discussed how current economic factors, especially interest rates, are influencing our clients’ decisions as to when to list a home for sale. The question put forward was whether to wait for the spring market to sell a detached home, at which time the Bank of Canada’s key lending rate is projected to be lower than it is today.

Many homeowners believe that selling when interest rates are low will mean more potential buyers and, consequently, higher prices. This makes sense in theory because lower rates mean cheaper loans, enabling more people to bid on a home.

However, this perspective simplifies the real-world complexities of the real estate market which is shaped by numerous factors beyond the Bank of Canada’s key lending rate. Consider this past month. Here are some recent changes that will be exerting some influence on the market over the coming months (and yes, rates do make the list):

1. Interest Rate Cut: The Bank of Canada lowered the key lending rate by a quarter point.

2. Stress Test Adjustment: Starting November 21, the Office of the Superintendent of Financial Institutions (OSFI) has removed the stress test requirement for uninsured mortgages when switching lenders, provided there are no changes to the loan’s terms (ie. amortization period or loan amount).

3. Increased Mortgage Cap: Effective December 15, the federal government will raise the insured mortgage cap from $1 million to $1.5 million, reflecting current values and helping more Canadians qualify for a mortgage with a downpayment below 20 percent.

4. Extended Amortization Periods: Also from December 15, 30-year mortgage amortizations will be available to all first-time homebuyers and those purchasing new builds, which should help ease monthly payments.

Each of these factors are expected to influence demand by making homeownership more attractive and more accessible, bringing more buyers into the market, increasing competition, putting upward pressure on home prices, and generating more sales activity.

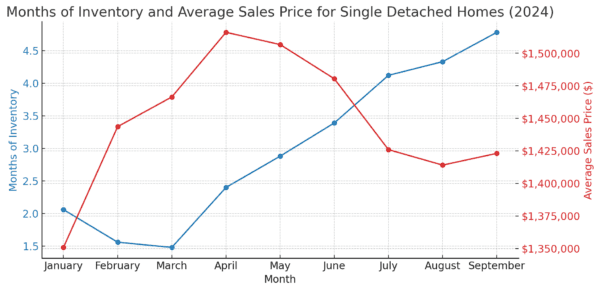

Let’s look at the other side of the equation and one of my preferred market indicators: Months of Inventory. I like this metric because there is a clear inverse relationship between supply and price, particularly when demand is unchanged. Put simply, when there is an increase in the supply of homes, and demand remains stable, there is downward pressure on the price of homes. When there is a reduction in the supply of homes and demand remains stable, prices will rise.

The chart below provides a graphic illustration of Months of Inventory for single detached homes, sitting alongside the Average Sales Prices for single detached homes in the Greater Toronto Area through the first three quarters of 2024:

As the data shows, we began the year with 2-months of inventory, which fell to 1.5 in March, and grew to where we sit today at 4.8-months of inventory. This is virtually in lockstep with Average Sales Price, which began at approximately $1.35M rising to $1.52M by April, and then trending downward to $1.42M in September. If one were planning to time the market in the spring when rates are projected to be lower, I would argue that others might have a similar notion. What then will the ensuing glut of supply do to real estate prices? I don’t know the answer…none of us have a crystal ball.

I don’t know what supply will look like in March, just as I don’t know what the interest rate will be in March. But I do know that there are many inputs that affect market price. The notion that Lower Interest Rates = Higher Prices is false. Perhaps in a vacuum, but the market for real estate in the GTA is not a vacuum.

Our market is influenced by a myriad of factors, making the concept of timing based on interest rates too simplistic. For most of us, buying and selling within the same market conditions is the soundest strategy.

At Harvey Kalles Real Estate, our agents are well-equipped with the latest data and economic insights to guide our clients through these complexities, ensuring that you can make the most informed decisions without the gamble that comes with timing the market.

As always, I encourage you to speak with myself or a member of the sales team. We have been in business since 1957 and can expertly guide you through any real estate market environment.